Instant Legal Insurance - Botswana Legal T&C's

INSTANT LEGAL INSURANCE - P49

Thank you for your purchase! This Instant Legal Insurance policy document explains the types of benefits and conditions that are applicable to you for this cover.

- Coverage commences only after activation and receipt of confirmation SMS, subject to waiting periods and policy terms.

- Policy is void if false information is given or if activation does not occur.

- You may cancel this policy via written notice or through the mobile app.

- No amendments are binding unless agreed in writing by the insurer.

- 30-day cooling-off period applies.

Definitions

- INSURED: The person named in the schedule.

- INSURER: Alpha Direct Insurance Company (Pty) Limited.

- Covered Persons: Is you, the person stated in the schedule as the insured- Your spouse, dependant minor children or dependent parents if they are ordinarily resident with you

- Child: A person under the age of 18 years, and financially dependant on you; Includes your biological, adoptive or step-child, and any foster-child placed in your care by a Court Order.

- INSURED EVENTS: Shall mean the incident or the start of the transaction or series of incidents that may lead to a claim being made under this policy, but excluding the events expressly excluded under this Policy.

- THIRD PARTY: Shall mean the opposing side in the proceedings brought against you or by you.

- EXTERNAL ATTORNEYS: Shall mean the Attorney or other appropriately qualified person, firm or company nominated to act for the INSURED who is not a full time employee of the INSURER.

- PROCEEDINGS: Shall mean the pursuit or defence of civil, criminal, tribunal or arbitration matters instituted and based on an insured event.

- LEGAL COSTS AND EXPENSES: Fees, costs and disbursements reasonably incurred by the Legal service provider, excluding costs of civil proceeding incurred by a Third-Party, including Deputy Sheriff charges, tracing and search charges for defendants.

Commencement of Cover and Limits of Indemnity

- Payment of Premiums :-Only the INSURER is authorised to accept payment

of premium from the INSURED: Provided that -

- 1.Indemnity will not be granted unless payment is received by the INSURER on due date

- 2. It is the INSURED’S responsibility to ensure that payment is received by the INSURER on due date; the granting of a Debit Order or similar authority, allowing the INSURER through a collecting institution to deduct premiums from the INSURED’S bank, building society or other account, shall not constitute payment, unless payment is received on due date.

- 3.If payment has not been received by the INSURER on the applicable due date set forth in the policy schedule, the INSURER shall reserve the right to collect the INSURED’S non–payment in respect of a double debit the following month, alternatively by other means as agreed by the parties, reduced to writing from time to time.

- 4.If payment has not been received for three (3) consecutive months the INSURER reserves the right to cancel the policy by giving the insured a 30 day notice in writing.

- 5.The INSURER reserves the right to ask for premium to anniversary and/or any outstanding premiums prior to settling a claim. The INSURER shall review premiums annually and may increase premium. Such premium escalation shall not exceed 50% and the adjustment shall arise from increased operating costs of the INSURER.

Indemnity Limit

- For all legal matters covered by this policy but for which a specific limit of Indemnity has not been specified in the Commencement of Cover and Limits of Indemnity table below the limit of indemnity shall be the amount stated in the schedule of benefits.

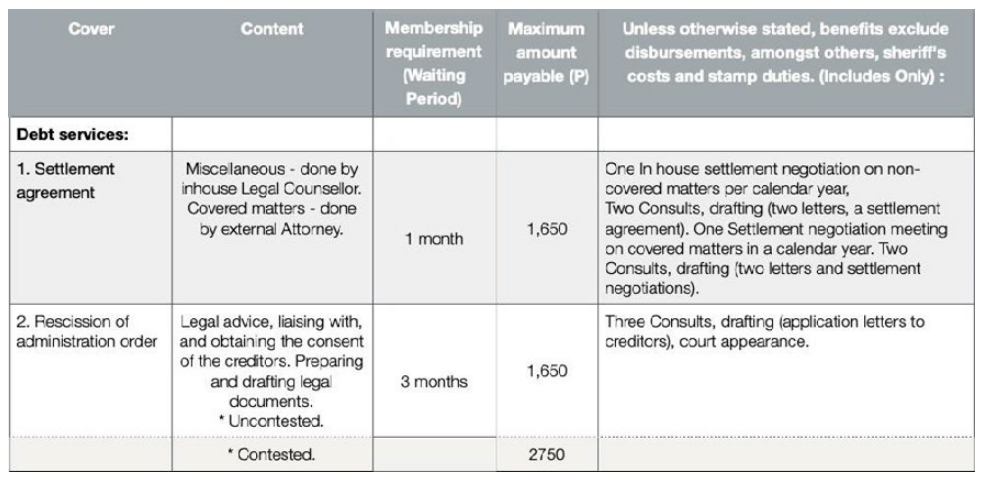

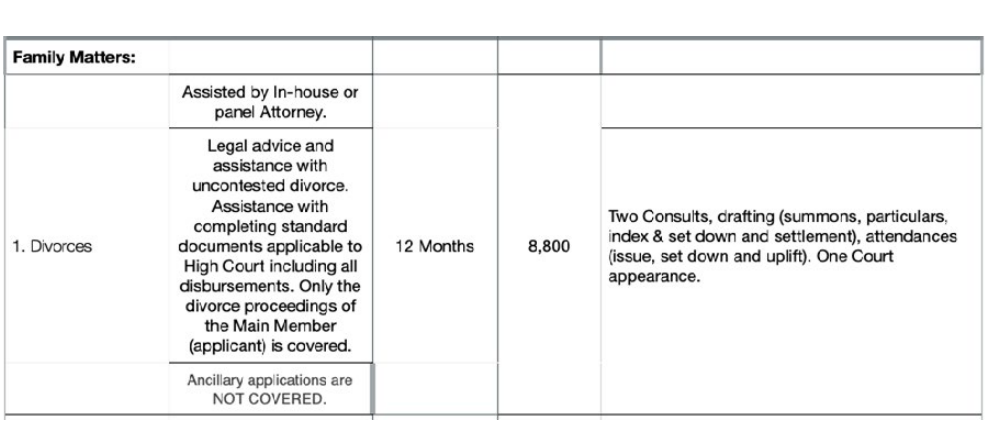

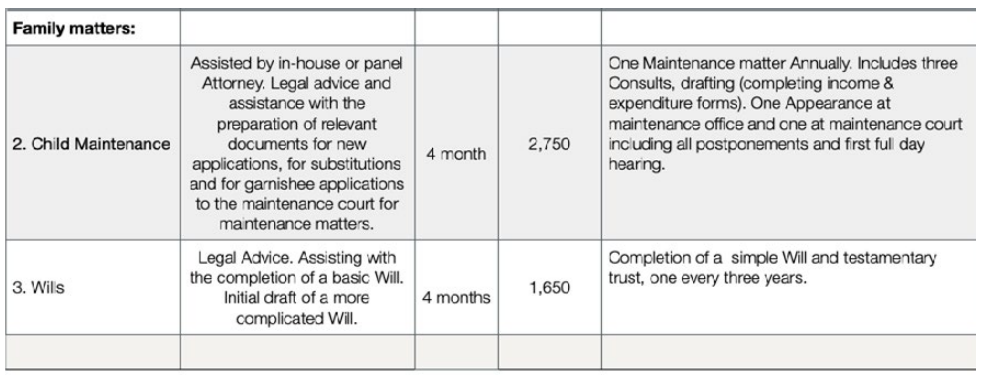

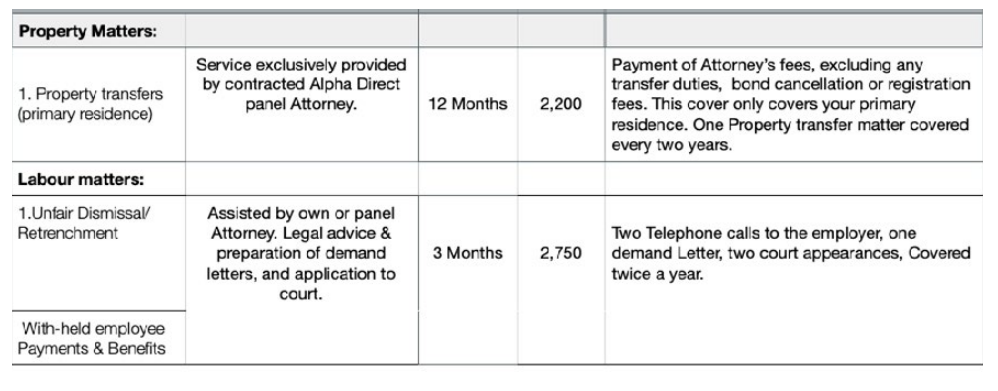

Schedule of benefits

- The maximum limit of indemnity under this policy provided by the company during any calendar year shall not exceed Ninety-thousand Pula (P90,000) subject to the sub-limits as specified in the commencement of cover and limits of indemnity table below.

Legal Service Provider

- A practising attorney, duly admitted to practice in Botswana in accordance with the provisions of the Legal Practitioners Act as amended from time to time, who are selected by the INSURER.

Period of insurance

- The twelve month period beginning with commencement of cover and terminating twelve months thereafter or any subsequent twelve month period. This is an annual policy paid and automatically renewed on a monthly basis.

Reinstatement

- In the event that the POLICY has lapsed, it shall without a new proposal being submitted, be reinstated upon receipt of premium, provided always that the waiting period provisions in the policy shall apply to the reinstatement period. The cover shall be from the moment of reinstatement and not for the months that the INSURED was in arrears.

Jurisdiction

- The exclusive jurisdiction pertaining to this policy shall be the Republic of Botswana. All incidents, transactions and/ or proceedings taking place outside Botswana’s jurisdiction are not covered by the policy.

No increase in benefits

- Continuation of this policy from one benefityear to the next will not increase our liability beyond the limits stated in the table even though an insured event may span over two or more benefit years.

Indemnity to you

- We will indemnify you up to the indemnity limit in respect of legal expenses incurred by you during the period of insurance subject to the terms and conditions of this policy.

The indemnity limit will be applied as follows

- We will pay the fees and disbursements charged by the legal service provider representing you. up to the limit of the cover.

- Legal cost/expenses shall be paid to the legal service provider based on tariff negotiated with the legal service provider.

If costs are awarded in your favour:

- 1.This policy constitutes a cession to us of any right

of recourse by-

a. you against any party for recovery of legal expenses for which we indemnified you in terms hereof and/or

b. your legal service provider arising from the execution by the latter of the relevant mandate insofar as it relates to wasted legal costs or legal expenses unnecessarily incurred. - 2.Such costs shall automatically accrue to us to the extend to which we have indemnified you.

- 3.You will be responsible throughyour legal service provider for repayment to us of any award of such costs or any costs agreed to be paid to you as part of any settlement.

- 4.You will instruct your legal service provider to recover any such costs, failing which we shall have a right of recourse against you.

CONDITIONS

- Breach of conditions:We may in our sole discretion decline to pay any legalexpenses if the insured breaches any material condition of this policy.

- Indulgences: If for any reason we do not enforce any provision in this policy strictly or at all, this does not mean that we waive any of our rights or change our obligations under this policy nor will that indulgence stop us from enforcing this policy strictly thereafter.

- Misdescription, misrepresentation or nondisclosure:We may decline to indemnify you in the event of any misdescription, misrepresentation or non-disclosure before or during the activation of this insurance policy, the subsequent period of insurance or at any time thereafter

- Conduct:The INSURED shall at all times promptly give to the INSURER all such information as the INSURER may request and shall give the EXTERNAL ATTORNEYS a complete and truthful account of the facts of the claim and shall supply such person with all evidence in the possession requested by the EXTERNAL ATTORNEY and shall procure or execute all documents reasonably requested by the EXTERNAL ATTORNEY and shall attend upon him when so requested

Cancellation

- 1. Either party may cancel this policy by giving the other party at least one month’s notice in writing. Cancellation will be effective from the end of the month for which premium was last received.

- 2. If the premium is not paid on the agreed date, the policy will be cancelled automatically from midnight on the last day of the month for which premium was received, unless you can show that non-payment was due to an error by us.

- 3. If the policy is cancelled during the currency of a valid claim, then it shall continue in full force and effect for the purposes of that claim only, subject to all premiums being up to date.

- 4. Where either party cancels the policy and the INSURED had paid a lump sum annual premiums in advance, the INSURER, shall within 30 days refund the INSURED the unearned premiums.

Amendemets:

- 1. Notwithstanding anything contrary contained in this policy , the INSURER may from time to time propose amendments to the terms of the policy and schedules. Such amendments may include changes required to align with changes in legislation and/or regulations or premium adjustments to align to changes in benefits included in the policy.

- 2. The INSURER shall timeously serve written notification of any such amendments to the INSURED and such notification shall not be less than 60 (sixty) days from the intended date of implementation.

- 3. The INSURED shall within 30 (thirty) days of any notification of amendment to the Policy and/or schedule, have the right to cancel the policy, and receive from the INSURER in the case of an annual premium a refund of premium, calculated on the unexpired portion of the duration of cover, less any claims paid or due in the applicable year: Provided that, failure to respond on the part of the INSURED as stipulated herein, shall constitute an acceptance of the amended terms.

Claims:

- 1. In the event of a possible claim you must, before taking any other action, contact our 24-hour help line.Our consultant will provide you with assistance on any legal matter, and advise you how to proceed in the event of a valid claim against the policy.

- 2. You must in any event contact us within 24 hours of receiving any summons, charge sheet or other legal document, or as soon as reasonably possible to do so provided that you do not exceed a period of 7 days, failure of which shall result in us repudiating your claim.

- 3. The INSURER shall not be held liable where the INSURED has failed to timeously lodge their claim. You must give us written details of any claim on our prescribed form, together with details of any other insurance covering the same legal benefit.

- 4. The company will have the opportunity to negotiate at its sole discretion and conclude a reasonable settlement of any matter before we give confirmation of valid claim.The INSURED shall not without the prior written consent of the INSURER, admit liability.

- 5. You may not consult a legal service provider without our written confirmation of valid claim.

- 6.You must give us and the legal service provider

a. any other information and assistance required, and

b. all documentation held or received by you regarding the claim. - 7. If we decline to indemnify you in respect of any claim, and summons and appeal is not served on us within one month of us declining, we will be relieved of any liability for that matter. INSURER shall repudiate the claim and advice the INSURED in writing of the reasons for the repudiation. The INSURER shall then be under no, or no further, liability to indemnify the INSURED.

- 8. All legal matters must follow the procedure as stipulated in the respective statutes /legislation applicable to courts of applicable jurisdictions.

Disputes between insureds:

- A dispute arising between more than one INSURED each having their own legal expenses policy, shall be resolved by referring each claim to different EXTERNAL ATTORNEYS.

Prevention and minimization of claims:

- You must take all reasonable steps to:

- 1. Safeguard your legal rights and to ensure that they are not violated, and shall enforce remedies capable of enforcement without the assistance of a legal service provider.

- 2. Minimise the risk or likelihood of claims and the cost of legal proceedings.

- 3. Mitigate any damages you may suffer.

- 4. Prevent any occurrence that may give rise to a claim under this policy.

- 5. Not accept liability on behalf of the INSURER in any manner.

Other similar insurance

- The insured cannot claim for the same benefit under

two policies and we will only indemnify your legal

expenses as contained in the table of insurance if

you do not have other similar insurance for the same

legal matter.

- Authority: This policy is proof of your authority, in the event of you being charged with a criminal offence, to us to obtain at the Botswana police or any other authorities to provide any record of prior criminal proceedings pertaining to the accused.

- Appeal or Review Proceedings::

We will not be liable to indemnify you in respect

of appeal or review proceedings unless written

authority to proceed with the proposed proceedings has first been obtained from us. Such authority shall

not be granted unless the legal service provider has

given us a written statement, confirmed in writing by

an Attorney of the High Court of not less than five

(5) years’ standing, that the proceedings have a

reasonable prospect of success.

In the event that the appeal or review proceedings are lodged against you, we shall indemnify you upto the limit of the cover or the remaining portion thereof after indemnifying you at the Court of first instance. - Settlement:

You may only accept any settlement, payment

into court or tender, or withdraw any action or

defence that includes any costs award either

against you or in your favour, with our written

consent. In the event of such consent being

given, you will be liable to us for;

a. any costs awarded against you in excess of the party and party scale.

b. the amount of any party and party costs not awarded to you in terms of such settlement. - You may not accept any settlement, payment into court or tender, or withdraw any action or defence with each party being responsible for its own legal costs, without our written consent.

- We will be entitled to withhold our written consent specified in this clause until we have received satisfactory security for payment of any amount due to us.

- Should you refuse an offer of settlement, payment into court or tender made with or without prejudice, and thereafter at the final end and determination of the matter be awarded or accept an amount equal to or less than the amount of such offer, payment or tender, you will forfeit Indemnity in respect of all legal expenses incurred from the date of such offer, payment or tender and we will be entitled to deduct the forfeited expenses from any settlement awarded to you or proceed against you for the recovery thereof.

- A matter will not be regarded as settled until either the action or defence is formally withdrawn or a settlement agreement is made an order of the court.

- The INSURER shall instruct the EXTERNAL ATTORNEY to attempt settlement of any claim either by negotiation or by arbitration.

EXCLUSIONS AND LIMITATIONS:

- We will not indemnify you in respect of the following

claims or claims arising from any of the following

events:

- 1. An INSURED EVENT occurring outside the Republic of Botswana.

- 2. An INSURED EVENT that occurred prior to the commencement of the insurance cover under this policy.

- 3. A false or fraudulent claim.

- 4. Any claim where the INSURED acts contrary to the advice of the INSURER or the EXTERNAL ATTORNEYS.

- 5. Any claim where legal action is instituted by the INSURED against his/her attorney in his professional capacity.

- 6. Any claim where INSURED seeks to challenge the Constitution or any other statute of the Laws of Botswana or any legal action arising from a political activity.

- 7. Any claim where an action is instituted by the INSURED against the INSURER, its parent company or any subsidiaries or associated companies

- 8. Any claim where INSURED initiates or defends against an action in any representative capacity of a juristic person or group of natural persons howsoever composed.

- 9. Any claim where INSURED initiates or defends against an action relating to any commercial activity carried on by the INSURED. This includes business/commercial activities and/ or professional services offered by the INSURED either in his/her personal capacity or via a company, syndicate, or partnership. If the INSURED seeks to take legal action or legal action is taken out against the INSURED in relation to business/commercial activities and/ or professional services offered by the insured or by virtue of the INSURED’s membership of any commercial or civic body, this will not be covered.

- 10. Any claim arising in connection with recovery or payment of any excess for any insurance.

- 11. Any claim where the INSURED is entitled to indemnity under any other policy or certificate, or where the entitlement to such indemnity is repudiated in terms of the policy or certificate. This includes public liability insurance with legal costs extension.

- 12. Any claim directly or indirectly caused by or

contributed to or arising from:

12.1. Civil commotion, labour disturbances, riot, strike, lockout or public disorder or any act or activity that is calculated or directed to bring about such incidents;

12.2. Any of the foregoing which is not work related : strikes, mutiny, military rising, military or usurped power, martial law or state of siege, or any other event or cause which determines the proclamation or maintenance of martial law or state of siege, insurrection, rebellion or revolution;

12.3. Any act (whether on behalf of any organization, body or person, or group of persons) calculated or directed to overthrow or influence any State or Government, or any provincial, local or tribal authority with force, or by means of fear, terrorism or violence;

12.4. Any act which is calculated or directed to bring about loss or damage in order to further any political aim, objective or cause, or to bring about any social or economic change, or in protest against any State or Government, or any provincial, local or tribal authority, or for the purpose of inspiring fear in the public, or any section thereof; 12.5. Any attempt to perform any act referred to in clause 12.1, 12.2. 12.3 and /or 12.4 above; If the INSURER alleges that by reason of clause 12.1, 12.2. 12.3 and / or

12.4 above, a claim is not covered by this policy, it is the express intention of the parties that the burden of proving the contrary shall rest on the INSURED.

12.6. Any claim arising out of the cession, assignment or delegation in favour of the INSURED or by the INSURED. - 13. LEGAL COSTS AND EXPENSES arising from nonlitigious matters. This shall include but is not

limited to;

13.1. LEGAL COSTS AND EXPENSES for Criminal claims where the insured was previously convicted or for criminal claims where the INSURED paid a fine as an admission of guilt for the offence charged.

13.2. Matters with monetary value of less than P10 000.00 (Ten Thousand Pula) or any that fall within the jurisdiction of the Small Claims Court.

13.3. LEGAL COSTS AND EXPENSES arising from conveyancing transactions.

Notice and Communications

- All notices and communications by the INSURER will be considered to have been duly sent by the INSURER to the domicilium citandi et executandi of the INSURED, as per SCHEDULE. It is the responsibility of the INSURED to constantly and timeously inform the INSURER of any changes in contact details.

Contact

Alpha Direct Insurance Co.

2nd Floor, Bar 2, Botswana Innovation Hub, Block 8 Industrial, Gaborone

www.alphadirect.co.bw/box

Tel: (0800) 601 029 (press option 7)

© . Alpha Direct Insurance Company (Pty) Ltd. All rights reserved.

Authorized Financial Services Provider | NBFIRA License No. 2/9/179